Tax Bracket Married 2025. The federal income tax has seven tax rates in 2025: You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax years.

Based on your annual taxable income and filing status, your tax bracket determines your. To figure out your tax bracket, first look at the rates for the filing status you plan to use:

For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

2025 Tax Brackets Married Filing Separately 2025 Kathy Iolande, And for heads of households, the. Based on your annual taxable income and filing status, your tax bracket determines your.

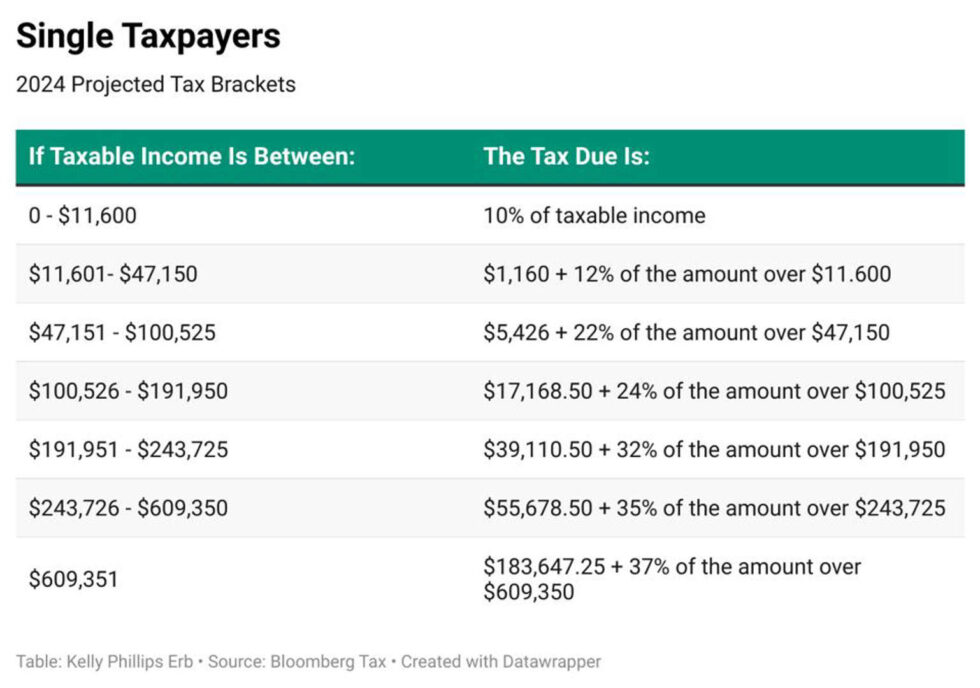

2025 Tax Brackets Married Filing Jointly Dana BetteAnn, Here's what to know about proposed tax brackets, capital gains rates and more. For tax year 2025, which applies to taxes filed in 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%.

2025 Tax Brackets Married Filing Separately Excited Idalia Friederike, Vice president kamala harris may be the 2025 democratic party nominee following president joe biden’s. Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they change how much you pay in federal income.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, The highest earners fall into the 37% range, while those who earn the. For 2025, inflation adjustments increased the size of tax brackets by about 5.4%.

What Are The Tax Brackets For 2025 Single Married Dacia Jennine, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025; These are the same tax.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Is The Tax Bracket For Married Filing Jointly 2025 Star Zahara, Based on your annual taxable income and filing status, your tax bracket determines your. The irs released these brackets and income levels for 2025:

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, Project 2025 could bring sweeping tax changes under a second trump term. Explore the 2025 tax bracket changes for singles, households, and married filing statuses in our blog.

Tax Brackets 2025 Single Vs Married Row Hedvige, Here are the 2025 tax brackets, for tax year 2025 (returns filed in 2025). For the 2025 tax year, the standard deduction is $29,200 for married couples who file jointly and $14,600 for both single filers and married filers who file.

2025 Tax Brackets Married Filing Jointly Cilka Delilah, Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they change how much you pay in federal income. For the 2025 tax year, the standard deduction is $29,200 for married couples who file jointly and $14,600 for both single filers and married filers who file.

Irs Tax Brackets 2025 Married Jointly Lee Karalee, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025; See current federal tax brackets and rates based on your income and filing status.